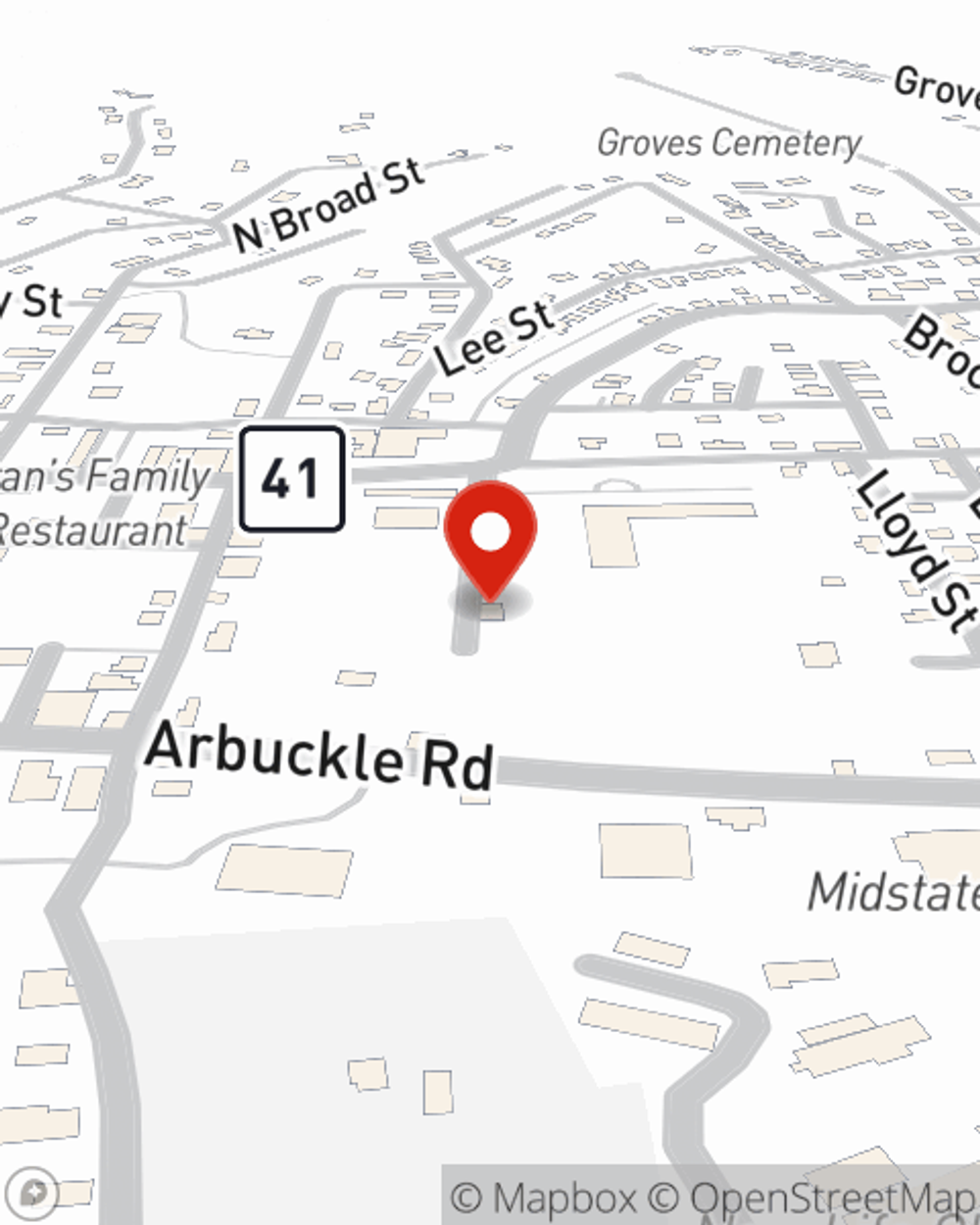

Homeowners Insurance in and around Summersville

Looking for homeowners insurance in Summersville?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Summersville

- Nicholas County

- Craigsville

- Fayetteville

- Richwood

- Clay

- Nettie

- Canvas

- Mt Nebo

- Mt Lookout

- Ansted

- Sutton

- Oak Hill

- Cowen

- Webster Springs

- Birch River

- Servia

- Strange Creek

- Fayette County

- Webster County

- Braxton County

- Rainelle

- Greenbrier County

Insure Your Home With State Farm's Homeowners Insurance

You want your home to be a place of refreshment when you're tired from another long day. That doesn't happen when you're worrying about making sure you don't burn the cake, and especially if your home isn't covered. That's why you need us at State Farm, so all you have to worry about is the first part.

Looking for homeowners insurance in Summersville?

The key to great homeowners insurance.

Why Homeowners In Summersville Choose State Farm

Becky Lyons can walk you through the whole coverage process, step by step. You can have a straightforward experience to get an insurance policy for everything that’s meaningful to you. We’re talking about more than just protection for your electronics, furniture and appliances. Protect your family keepsakes—like mementos and collectibles. Protect your hobbies and interests—like sports equipment and tools. And Agent Becky Lyons can share more information about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or choose a higher deductible, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

Whether you're prepared for it or not, the unpredictable can happen. But with State Farm, you're always prepared, so you can kick back knowing that your belongings are safe. Additionally, if you also insure your pickup truck, you could bundle and save! Contact agent Becky Lyons today to go over your options.

Have More Questions About Homeowners Insurance?

Call Becky at (304) 872-0383 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.

Becky Lyons

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help conquer home humidity problems with these tips

Help conquer home humidity problems with these tips

High home humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces. Help clear the air with tips on how to reduce indoor humidity.